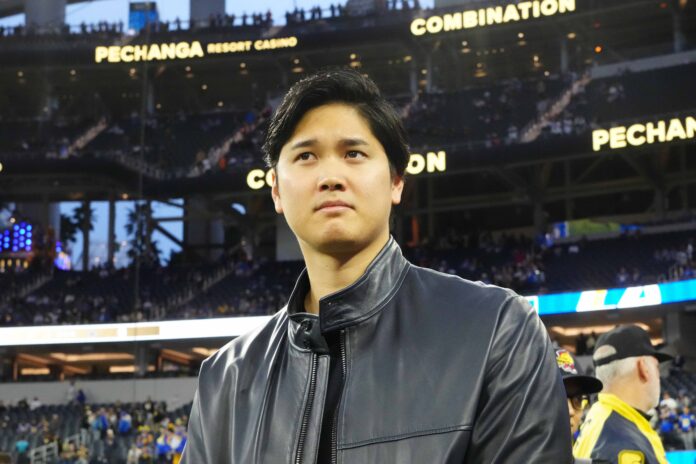

Shohei Ohtani’s signing with the Los Angeles Dodgers has undeniably been the highlight of MLB’s offseason. However, what sets his contract apart is its unconventional structure, taking the baseball world by surprise.

Ohtani’s deal with the Dodgers was deliberately crafted to enable Los Angeles to continue their spending spree. Under this unique arrangement, he will receive an annual salary of $2 million from 2024 to 2033. What truly raises eyebrows is the staggering $68 million in deferred payments annually from 2034 to 2043.

The baseball community was not the only group taken aback by the nature of Ohtani’s contract. Malia Cohen, the controller for the state of California, weighed in on the matter, calling on Congress to address a potential tax loophole that could allow Ohtani to evade paying $98 million in California taxes.

Cohen voiced her concerns, stating, “The current tax system allows for unlimited deferrals for those fortunate enough to be in the highest tax brackets, creating a significant imbalance in the tax structure. The absence of reasonable caps on deferral for the wealthiest individuals exacerbates income inequality and hinders the fair distribution of taxes. I would urge Congress to take immediate and decisive action to rectify this imbalance.”

As the 2024 MLB season approaches, Ohtani, with his $2 million salary currently taxable in California, is set to make his debut for the Dodgers on March 20 against the San Diego Padres in Seoul.